Moving on with our series on state solar incentives and facts, below are Colorado solar incentives for the residential and commercial sector, followed by some fun Colorado solar energy facts. Enjoy!

First of all, it’s worth noting that Colorado has a net metering law in place. Under this law, electricity customers who produce solar power can get a credit on their electricity bill for excess electricity they send back to the grid. For investor-owned utility (IOU) customers, there’s a limit on that of 120% of the customer’s average annual electricity consumption. Credits can “roll over” to following months if no payment is due, and customers can choose to roll over credit indefinitely or to receive payment at the average hourly incremental cost after 12 months. One of the key points here is: “If the customer chooses this option, they will surrender all their kWh credits if and when they terminate service with their utility.”

Also, customers of IOUs can buy into a “community solar garden” — a solar project up to 2 megawatts in size — and receive credits or payments for electricity generated from the solar garden. Here are some more details: “A community solar garden may be owned by the utility itself or any other for-profit or nonprofit entity or organization, and must have at least 10 subscribers. Subscribers will receive kWh credits on their utility bills in proportion to the size of their subscription. Subscribers must be located in the same municipality or county in which the community solar garden is located. If, however, the subscriber lives in a county with a population less than 25,000, they may subscribe to a community solar garden in an adjacent county provided the same utility serves the site of the community solar garden and the property being offset by the subscriber’s subscription. The PUC adopted rules to implement these new provisions in January 2012.”

Other than net metering, here are some Colorado solar policies that help to boost solar power adoption in the state:

Property Tax Exemption: Renewable energy property is generally exempt from Colorado property taxes. The stipulation is that renewable energy personal property be located on a residential property, owned by the residential property owner, and produce energy used by the residential property. (Commercial properties are also eligible for renewable energy property tax exemptions.)

Sales Tax Exemption: Sales, storage, and use of renewable energy systems is also exempt from the Colorado sales and use tax. This applies to solar water heat, solar space heat, solar thermal electric, solar thermal process heat, solar photovoltaics, and other renewable energy technologies.

Counties and municipalities may also offer property or sales tax exemptions or credits.

Direct Lending Revolving Loan Program: For commercial, industrial, or nonprofit renewable energy projects, there is also the possibility of getting a loan for $100,000 or more thanks to the federal American Recovery and Reinvestment Act of 2009.

Property-Assessed Clean Energy (PACE) financing was enabled in municipalities across Colorado but has been suspended in most locations until clarification on the legality of this option is confirmed by the Federal Housing Financing Agency (FHFA). Under PACE financing, basically allows people to borrow money from the local government for a renewable energy or energy efficiency project, and then pay the money back over time through higher property tax payments. “Local governments are authorized to issue bonds to fund the PACE programs, however voter approval is required. Once the program is established and funding is available, property owners within an improvement district may voluntarily apply and if selected, execute a contract for a loan. ”

Aside from all of the above, numerous incentives are available through counties, municipalities, and utility companies. If you’re in one of the following jurisdictions, click through on the link(s) below:

Local Grant Program

Local Loan Program

- Boulder County – Elevations Energy Loans Program

- City and County of Denver – Elevations Energy Loans Program

- Roaring Fork Valley – Energy Smart Loan Program

Local Rebate Program

- Boulder County – EnergySmart Commercial Energy Efficiency Rebate Program

- Roaring Fork Valley – Energy Efficient Appliance Program

- Roaring Fork Valley – Energy Smart Program

- Roaring Fork Valley – Renewable Energy Rebate Program

Performance-Based Incentive

- Black Hills Energy – Solar Power Program

- Xcel Energy – Solar*Rewards Community Program

- Xcel Energy – Solar*Rewards Program

Utility Loan Program

Utility Rebate Program

- Atmos Energy (Gas) – Energy Efficiency Rebate Program

- Black Hills Energy (Electric) – Commercial Energy Efficiency Program

- Black Hills Energy (Electric) – Residential Energy Efficiency Program

- Black Hills Energy (Gas) – Commercial Energy Efficiency Program

- Black Hills Energy (Gas) – Residential Energy Efficiency Program

- City of Aspen – Energy Assessment Rebate Program

- Colorado Natural Gas – Energy Efficiency Rebate Program

- Colorado Springs Utilities – Commercial Energy Efficiency Rebate Program

- Colorado Springs Utilities – Energy Efficient Builder Program

- Colorado Springs Utilities – Renewable Energy Rebate Program

- Colorado Springs Utilities – Residential Energy Efficiency Rebate Program

- Delta-Montrose Electric Association – Commercial Energy Efficiency Rebate Program

- Delta-Montrose Electric Association – Residential Energy Efficiency Rebate Program

- Empire Electric Association – Commercial Energy Efficiency Credit Program

- Empire Electric Association – Residential Energy Efficiency Credit Program

- Estes Park Light and Power Department – Commercial and Industrial Energy Efficiency Rebate Program

- Fort Collins Utilities – Commercial and Industrial Energy Efficiency Rebate Program

- Fort Collins Utilities – Home Efficiency Program

- Fort Collins Utilities – Residential and Small Commercial Appliance Rebate Program

- Gunnison County Electric – Residential Energy Efficiency Rebate Program

- Holy Cross Energy – WE CARE Commercial Energy Efficiency Rebate Program

- Holy Cross Energy – WE CARE Renewable Energy Generation Rebate Program

- Holy Cross Energy – WE CARE Residential Energy Efficiency Rebate Program

- La Plata Electric Association – Energy Efficient Equipment Rebate Program

- La Plata Electric Association – Renewable Generation Rebate Program

- Longmont Power & Communications – Commercial and Industrial Energy Efficiency Rebate Program

- Longmont Power & Communications – Residential and Commercial Appliance Rebate Program

- Loveland Water & Power – Commercial and Industrial Energy Efficiency Rebate Program

- Loveland Water & Power – Home Energy Audit Rebate Program

- Loveland Water & Power – Refrigerator Recycling Program

- Morgan County REA – Efficiency Credit/Rebate Programs

- Mountain View Electric Association, Inc – Energy Efficiency Credit Program

- Poudre Valley REA – Commercial Lighting Rebate Program

- Poudre Valley REA – Energy Efficiency Rebate Program

- Poudre Valley REA – Photovoltaic Rebate Program

- San Isabel Electric Association – Residential Energy Efficiency Rebate Program

- San Miguel Power Association – Energy Efficiency Rebate Program

- San Miguel Power Association – Renewable Energy Rebate Program

- Sangre De Cristo Electric Association – Energy Efficiency Credit Program

- SourceGas – Commercial Energy Efficiency Rebate Program

- SourceGas – Residential Energy Efficiency Rebate Program

- Southeast Colorado Power Association – Energy Efficiency Rebate Program

- United Power – Business Energy Efficiency Rebate Program

- United Power – Energy Efficiency Rebate Program

- United Power – Renewable Energy Rebate Program

- Xcel Energy (Electric) – Business Energy Efficiency Rebate Programs

- Xcel Energy (Electric) – Residential Energy Efficiency Rebate Programs

- Xcel Energy (Gas) – Business Energy Efficiency Rebate Programs

- Xcel Energy (Gas) – Residential Energy Efficiency Rebate Programs

- Xcel Energy – Residential ENERGY STAR Rebate Program

Overall, there are a large number of Colorado solar incentives. If you live in the state, you should take advantage of them!

Colorado Solar Energy Facts

With the legal, useful information out of the way, here are some particularly cool Colorado solar energy facts:

- There are currently more than 341 solar companies at work throughout the value chain in Colorado, employing 3,600.

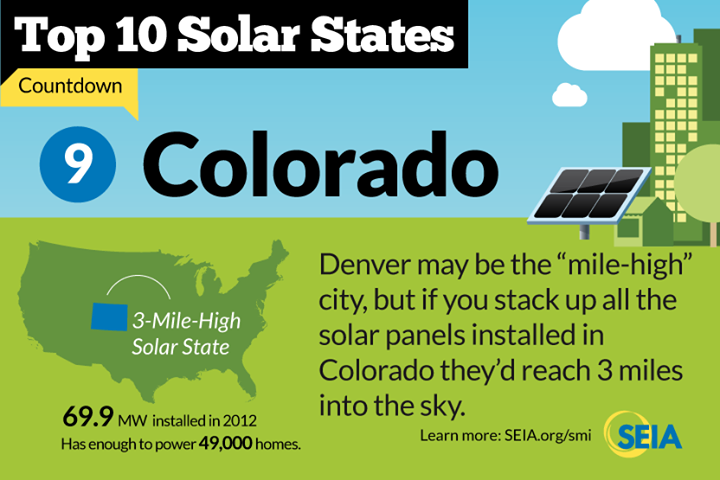

- In 2012, Colorado installed 70 MW of solar electric capacity, ranking it 9th nationally.

- The 298 MW of solar energy currently installedin Colorado ranks the state 6th in the country in installed solar capacity. There is enough solar energy installed in the state to power 53,600 homes.

- In 2012, $187 million was invested in Coloradoto install solar on homes and businesses.

- Average installed residential and commercial photovoltaic system prices in Colorado fell by 25% last year. National prices have also dropped steadily— by 11% from last year and 34% from 2010.

Average 20-year savings from going solar in Colorado are projected to total around $25,000, while internal rate of return (IRR) is projected to be 15%, even beating the S&P 500 and 30-year US Treasury Bonds. Impressive!

Colorado infographic via SEIA on Facebook

Leave a Reply

Solar Savings Calculator

Get the facts. Find out exactly how much solar will save you, including which Tax and Financial programs you qualify for!